Fair Finance Asia (FFA)

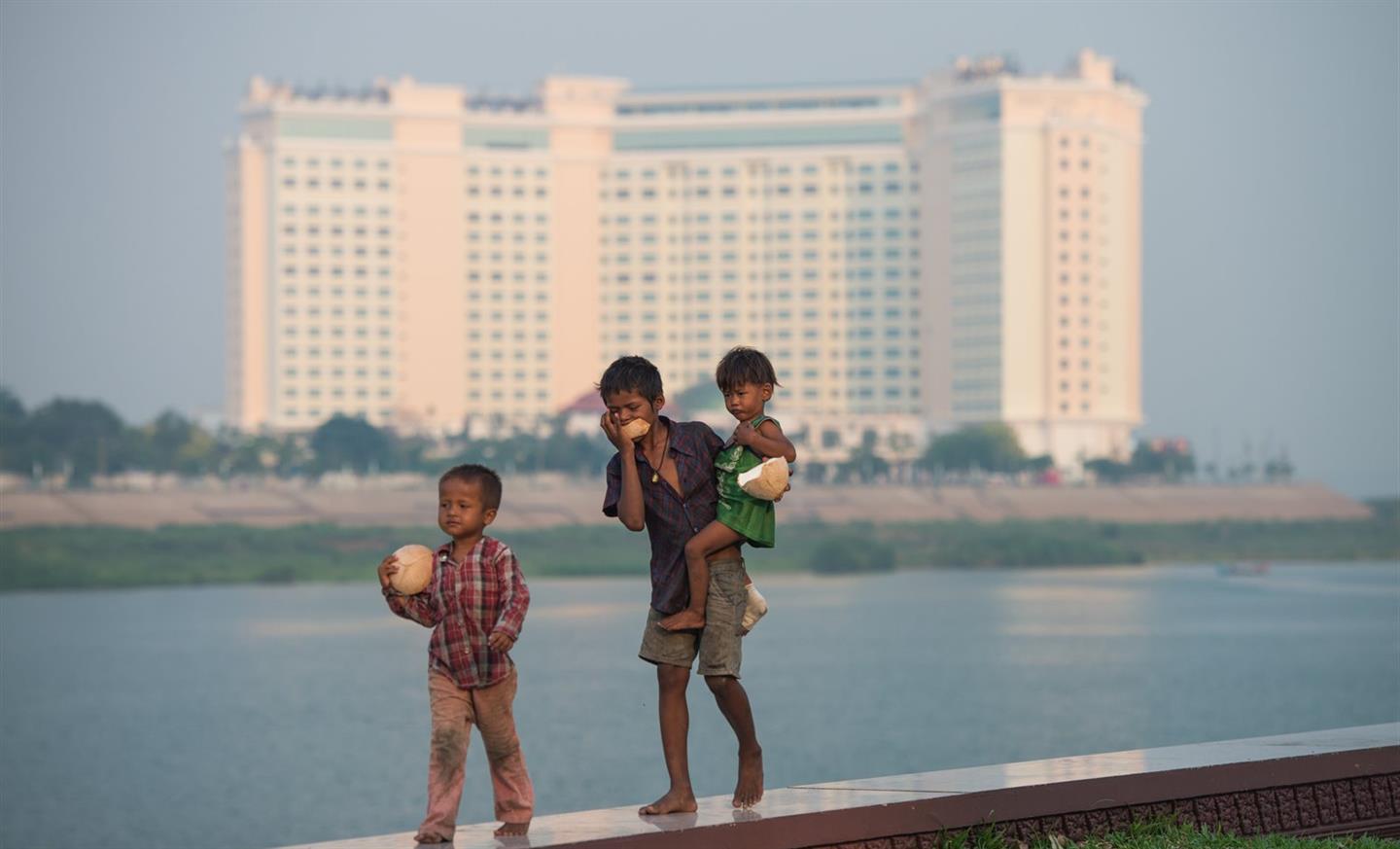

The FFA program focuses on reducing the negative impact of investments of regionally operating banks / insurers in Asia on human rights, the environment and climate change, and on increasing their investments in pro-poor inclusive economic development.

By stimulating more transparency and accountability in the financial sector, and by encouraging integration of human rights standards and environmental, social and governance (ESG) criteria in financial actors’ policies, the FFA program will help reduce the negative impacts of national and cross-border bank investments on human rights, the environment and climate change across the region. The cross-border nature of the problem requires an approach targeting both national and regional levels. The FFA program works with different stakeholders and their networks such as civil society organizations (CSOs), governments (at national and regional level), financial institutions, financial regulators, investors and development banks (IFC, ADB). The FFA program works in close alignment with the Fair Finance Guide International (FFGI) network and its methodology to assess the policy and practices of financial institutions.

The expected outcomes of this program include 1) increased awareness and (political) will among national governments, regulators, banks and banking associations to adhere to ESG standards; 2) champions among national governments and banks are interacting with regional bodies and are mutually influencing each other; 3) regional bodies (governmental, CSO and financial sector networks), development banks and investors are increasingly sensitive to policy asks of national FFG coalitions and other CSOs; 4) improved regulations by national governments and other financial sector regulators are in place, along with improved policies and practices by national banks; 5) a regional multi-stakeholder dialogue, including CSOs and allies, is started and results in a joint multi-stakeholder roadmap, and conditions for a multi-stakeholder initiative (MSI) are in place.

Facts:

Project name: Fair Finance Asia

Project period: The program builds on existing work and is designed for a period of five years (2017- 2021)

Target group: CSOs that consider financial flows of crucial importance for the development processes in their specific and/or global context, Financial institutions, Financial regulators, Investors, Development banks (IFC, ADB)

Location: The program has a regional program management unit (PMU) based in Cambodia and operates in six countries: Cambodia, India, Indonesia, Japan, Philippines, Thailand

Budget: 7 million

Contact:

For more information, please contact Petra Hamers (Program Lead Transparent and Accountable Finance)